How Much Can You Make to Qualify for Financial Aid

What's Covered:

- Maximum Income to Qualify for Different Types of Financial Aid

- Should You Apply for Financial Aid?

- How Much Will College Cost for Your Family?

As you look at colleges and begin to think about applying for financial aid, you may be wondering: what is the maximum income to qualify for financial aid? The good news is that there's usually no cutoff, but how much aid you receive does depend on income. In this post, we break down what the different types of financial aid are, the qualifications, and how you can apply.

What are the Different Types of Financial Aid?

When looking at financial aid, it's important to get a better understanding of the different types. There are two main kinds of financial aid: need-based and merit-based.

Need-based Aid: Need-based aid is exactly what it sounds like—it's based on your financial need and is calculated using the FAFSA. There are a couple of types of need-based aid: federal grants, institutional grants, loans, and work-study.

Merit-based Aid: Merit-based aid depends on your academic and extracurricular achievements with no regard for financial need. By building a strong academic and extracurricular profile, you can increase your chances of receiving this type of aid.

What is the Maximum Income to Qualify for Different Types of Financial Aid?

If you're looking to apply for financial aid, there's usually no maximum income cutoff. However, you're more likely to be eligible for certain types of aid depending on your income.

Federal Grant Eligibility

Federal grants are determined by the federal government and do not have to be paid back. These grants are all a type of need-based aid.

Pell Grants

Pell Grants are awarded to students who demonstrate high financial need. How much you receive depends on your Expected Family Contribution (EFC)—which is calculated using the FAFSA—cost of attendance, whether you're full-time or part-time, and how long you plan to attend the school.

For 2021, if your family's adjusted gross annual income is less than $27,000 and your EFC is calculated at zero, then you may receive the maximum amount in Pell Grant funding of $6,495 per year.

You can determine your Pell Grant funding based on Cost of Attendance and Expected Family Contribution.

Federal Supplemental Educational Opportunity Grant (FSEOG)

To qualify for the FSEOG, you must also qualify for a Pell Grant. This grant is also for students with exceptional financial need, but while the grant is federally funded, it is administered by the financial aid office at participating schools. Schools contribute their own funds to cover 25% of the total award.

Not all schools participate, so you'll need to check the specifics at the school you're attending. You can read more about the FSEOG and how to apply.

Iraq and Afghanistan Service Grant

In an effort to support the children of the heroic individuals who died in the Iraq and Afghanistan wars, the government created the Iraq and Afghanistan Service Grant. This grant is equal to the maximum value of the Federal Pell Grant for the year and cannot be greater than the cost of attendance of the school.

To qualify for the grant you must meet the following requirements:

- Lost a parent or guardian due to their military service in Iraq or Afghanistan after the events of 9/11.

- Were under 24 years old or enrolled at least part time in college at the time of the death.

- Failed to meet the requirements for a Pell Grant on the basis of their expected family contribution.

- Meet the remaining Federal Pell Grant eligibility requirements.

If you meet these requirements, all you need to do is apply.

TEACH Grant

Do you want to become a teacher? You may qualify for the TEACH grant. The Federal TEACH Grant provides you with money—roughly $4,000 a year—for your commitment to teach a high-need subject in a low-income area for at least four years after graduation.

To qualify, you must meet the basic eligibility requirements for federal funding. You're also required to complete the FASFA to determine if you qualify for the grant and how much funding you're eligible to receive.

In addition to basic eligibility, there are also academic, institutional, service, and administrative requirements.

Institutional Grant Eligibility

Institutional grants are given by the school, state, or other private institutions. Just like federal grants, institutional grants do not need to be paid back.

There is no hard cutoff for institutional financial aid, as schools consider many factors, such as income, assets, parent custody, caretaker responsibilities, number of siblings in college, etc. Highly-selective private schools may provide aid for families with substantial incomes, depending on their circumstances.

The cutoff also depends on the institution and the range can be broad. For example, Harvard says: "Families with incomes between $65,000 and $150,000 will contribute from 0-10% of their income, and those with incomes above $150,000 will be asked to pay proportionately more than 10%, based on their individual circumstances." Check with the schools you're applying to to get a better understanding of their institutional grant cutoffs.

Public schools, however, are less generous with need-based grants since the cost is often lower. Usually, only lower-income families will receive grants from public universities.

Both public and private universities may award merit aid to all students regardless of need (same goes for external scholarships). Merit aid and external scholarships are based on academic and extracurricular achievements.

Federal and Private Loans

Loans, unlike grants, do need to be paid back. Students can be granted both federal and state loans, or you can get a loan from a private lender.

Federal Loans

If you want to use loans to help finance your education, federal loans are the first option you should consider because repayment options tend to be more favorable. To apply for federal student loans:

- Start by filling out and filing the FAFSA (Free Application for Federal Student Aid).

- After you submit your FAFSA, you can expect to receive an award letter from your college's financial aid office. This document will include information on what loans are available to you, including Direct Subsidized and Unsubsidized options.

- Once you've had a chance to review your financial aid offer, you will need to contact the school to accept or reject any loans you received.

- The final step in the student loan application process is signing the paperwork, including a Master Promissory Note. This document confirms that you will repay your loans, along with any accrued fees and interest.

Private Loans

For private loans, you apply directly with the financial provider. Make sure to spend some time researching and look at rates and repayment terms.

To learn more about both federal and private loans, check out our post on how to apply for student loans.

Work-Study

Work-study is another option for need-based aid. In a work-study program you're able to work a part-time job and use that money towards all different aspects of your education, such as tuition or books. Work-study amounts are usually $1000-2000 per year.

Work-study is designed to emphasize civic engagement and to build career skills. When possible, work-study eligible jobs will most likely involve service work or will be related to your intended career path and can be on-campus or off-campus.

To qualify for work-study, you have to qualify for aid based on the FAFSA, as well as maintain a certain minimum GPA and complete some number of credits each semester, with specifications varying depending on your school. Work-study is not only for low-income students; even upper-middle class students can qualify for it, especially at expensive private schools.

Should You Apply for Financial Aid?

You should absolutely apply for financial aid unless you're 100% comfortable paying full sticker price. There are rarely any hard income cutoffs, so it's better to fill out the paperwork to determine your eligibility.

To get started applying for financial aid and to learn more about the different forms you need to complete, check out our complete guide to financial aid.

How Much Will College Cost for Your Family?

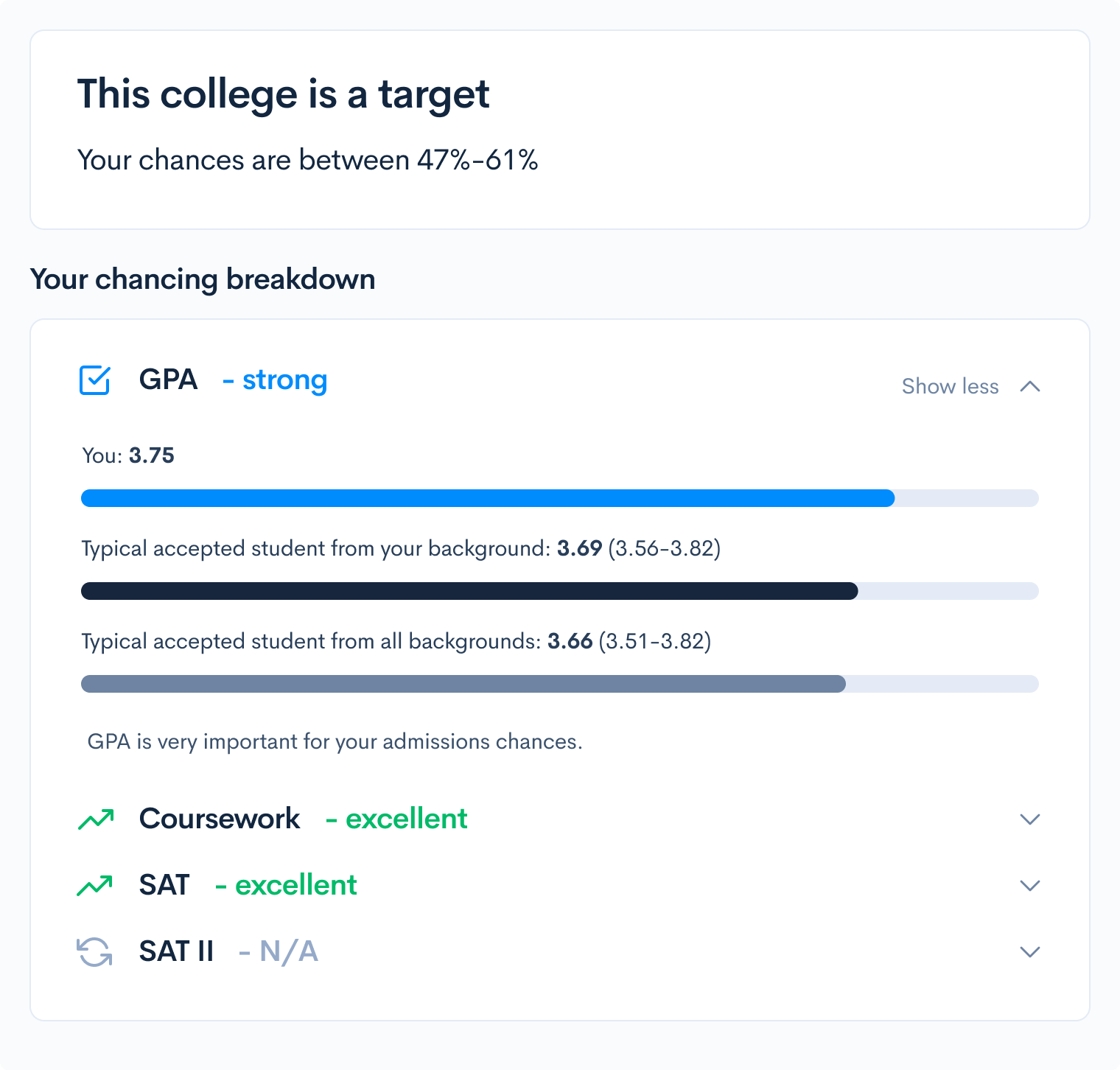

To get a better understanding of how much college will cost, check out our free chancing engine. You can see your expected cost of attendance at each school, which is based off of your real financial data. Plus, you'll get details about the ROI for specific majors at different schools. All you need to do is sign up for a free account to get started.

We at CollegeVine also offer our own $500 scholarship, which will be paid out directly to the student and has no income requirements. All you have to do is sign up for a free account and earn karma, the free CollegeVine "currency". You can earn karma by reviewing essays through our Peer Review tool and answering questions in our Community Forums. After earning that karma, you bid it to enter the scholarship drawing (if you don't win, that karma will be returned, where you can "spend" it on essay reviews and expert advice). You can enter the draw each week.

How Much Can You Make to Qualify for Financial Aid

Source: https://blog.collegevine.com/maximum-income-to-qualify-for-financial-aid/